Copyright©IBMI & RBMP. To share this article, please provide a link back to it.

Biomedical Sector Revenue & Growth, Q1 to Q3, 2021

- The currency used in this article is Taiwan Dollar (TWD).

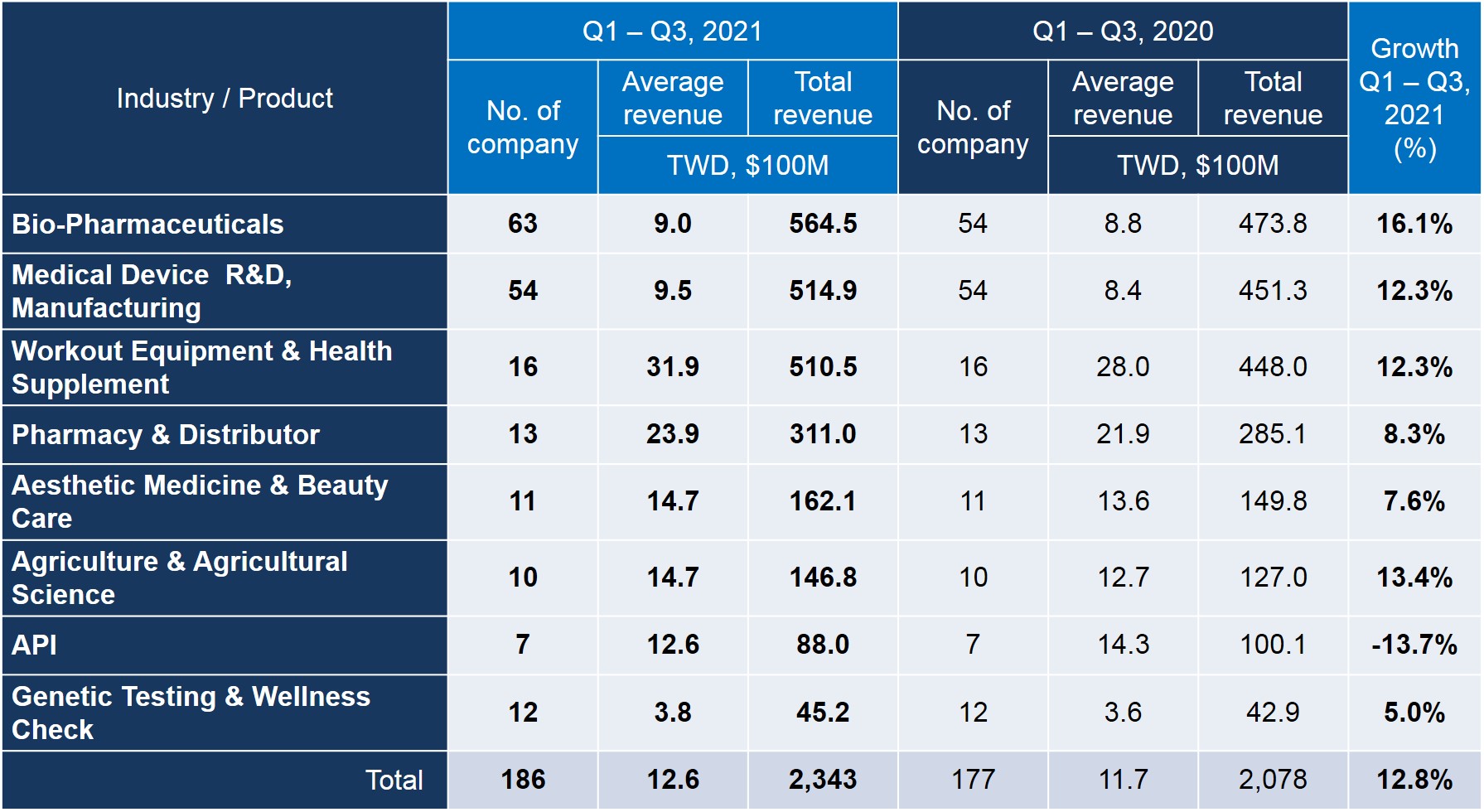

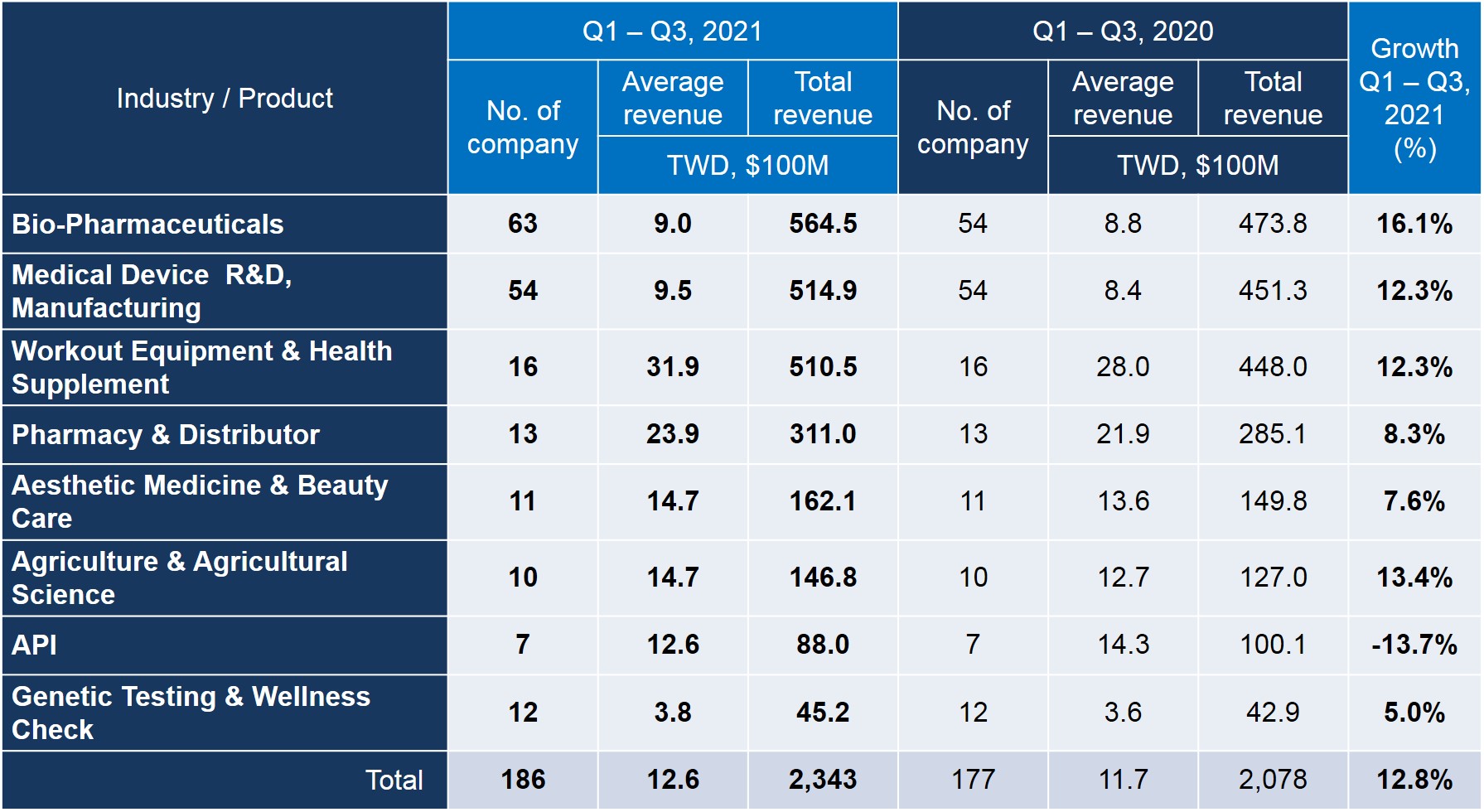

- The biomedical sector revenue totalled $234.3bn, up by 12.8% compared to Q1 to Q3 last year. The growth rate, however, was lower than 18.3% the average of the overall listed and OTC companies.

- 65 amongst 112 biomedical companies saw a decrease in revenue compared to Q1-Q3, 2020.

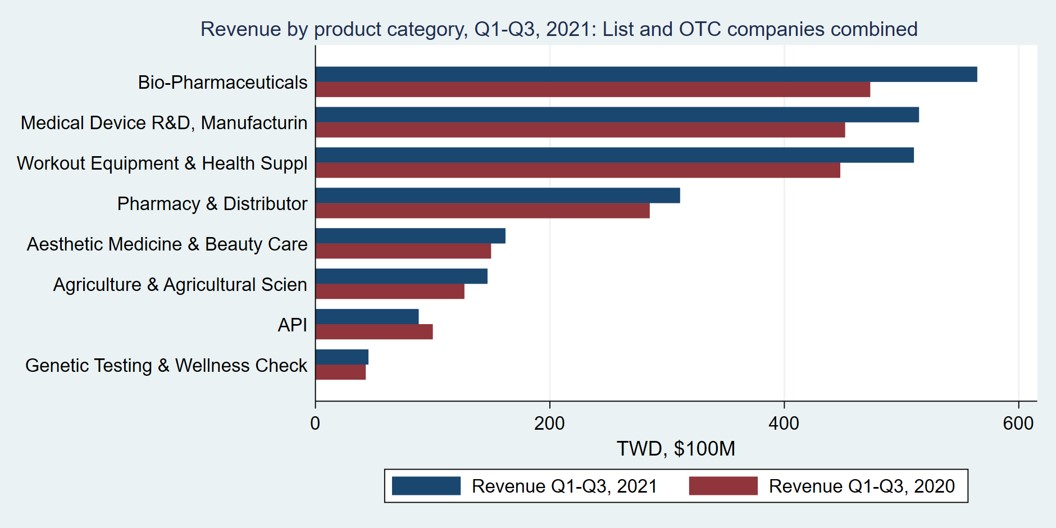

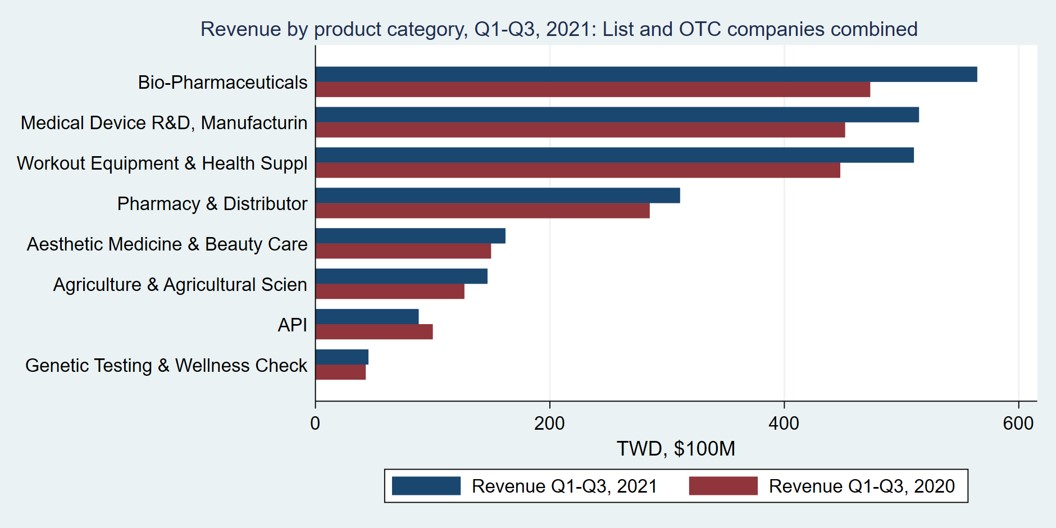

Growth by product category Q1 to Q3, 2021: Listed and OTC combined

- “Bio-pharmaceuticals” took the crown with the highest growth rate 16.1%, revenue $56.45bn.

- The champion in terms of the average revenue, went to ”Workout Equipment & Health Supplement”, with the average revenue $3.19bn. In that category, Johnson Health Tech topped the chart with $21.02bn, grew by 12.8%.

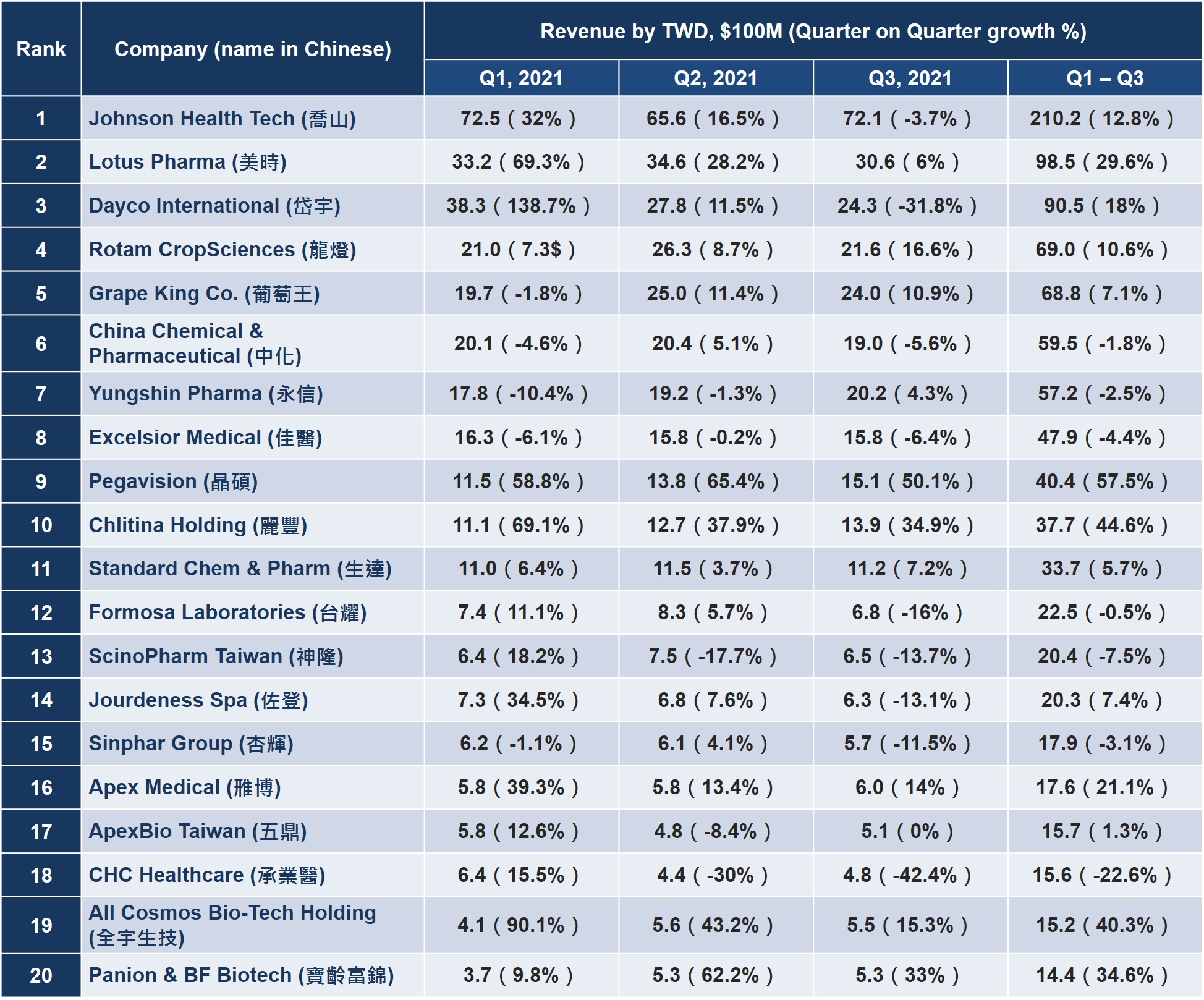

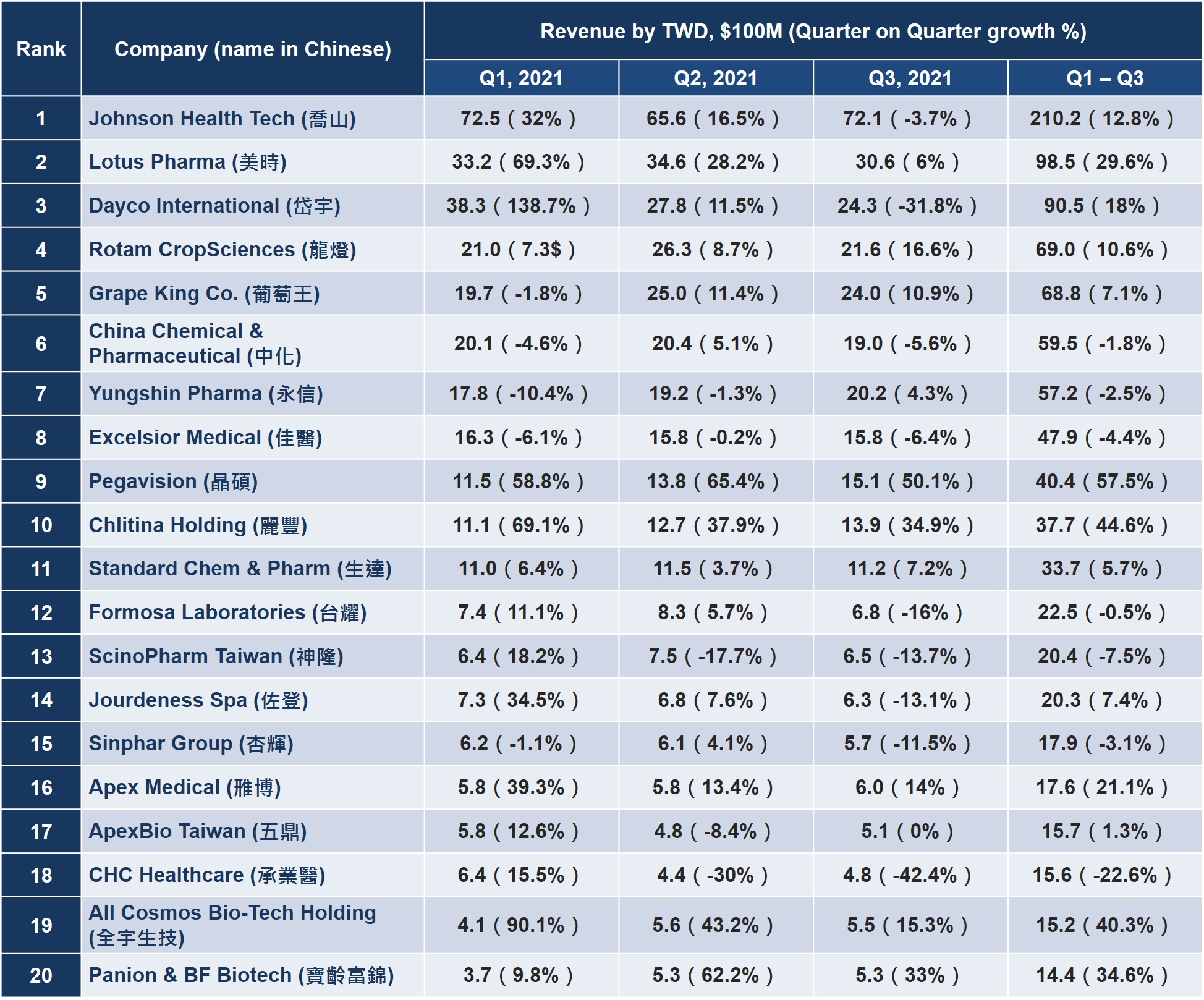

Top 20 by revenue Q1 to Q3, 2021: Listed companies only

- Top 3 companies by revenue were Johnson Health Tech ($21.02bn), Lotus Pharma ($9.85bn) and Dyaco International ($9.05bn).

- Top 3 companies by growth rate were Pegavision (57.5%), Chlitina Holding (44.6%) and All Cosmos Industries (40.3%). CHC Healthcare Group, in the meantime, posted the weakest growth rate (22.6%). Pagavision, a subsidiary of Pegatron, is known for contact lenses OEM manufacturing with 80% of products exported to China and Japan. The company’s silicone hydrogel and toric contact lenses had been CE-certificated and TFDA approved, respectively. Together with the sales of own-brand products picked up in Taiwan, Pegavision outperformed despite the global pandemic.

- Amongst all, CHC Healthcare Group suffered the most with both revenue and growth down ($1.56bn, -22.6%), followed by ScinoPharm ($2.04bn, -7.5%) and Excelsior Medical ($4.79bn, -4.4%). Due to the delayed FDA’s inspection and the tightened boarder control, ScinoPharm’s branded injectable products were led to fall behind the schedule.

Top 20 by revenue Q1 to Q3, 2021: OTC companies only

- Top 3 by revenue were Great Tree Pharmacy ($8.22bn), TCI Co. ($6.66bn) and Ginko International ($6.43bn).

- Top 3 by growth rate were Medigen Biotechnology (310.5%), Bora Pharmaceuticals (231.9%) and Great Tree Pharmacy (31.5%)- each came with a factor stimulating the income. Although Medigen did not make to the top 20 last year, its investment in Medigen Vaccine Biologics paid off because the later generated $1.25bn from its COVID-19 vaccine- a 272.1% increase as opposed to 2020. Bora’s buyout of GSK’s plant in Canada expanded not only its product portfolio but also the drug sale. And Great Tree embraced O2O commerce that turned out to be a good move.

- PharmaEssentia trailed (-14.2%) with its business hit in South Asia, where the shipping cost drove up because of the coronavirus pandemic. Following a downward trend on new infections, the company has recovered in part since Q3.

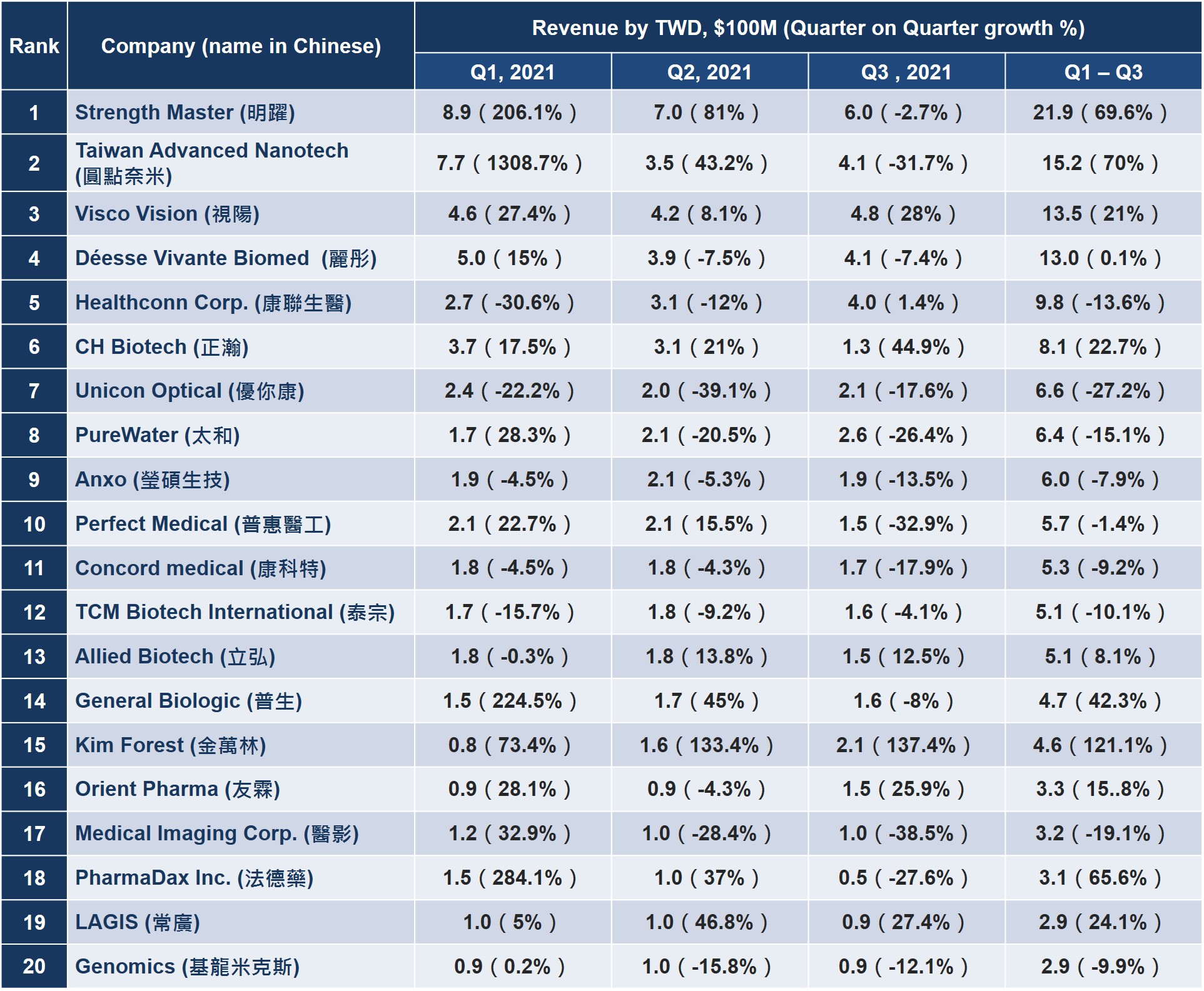

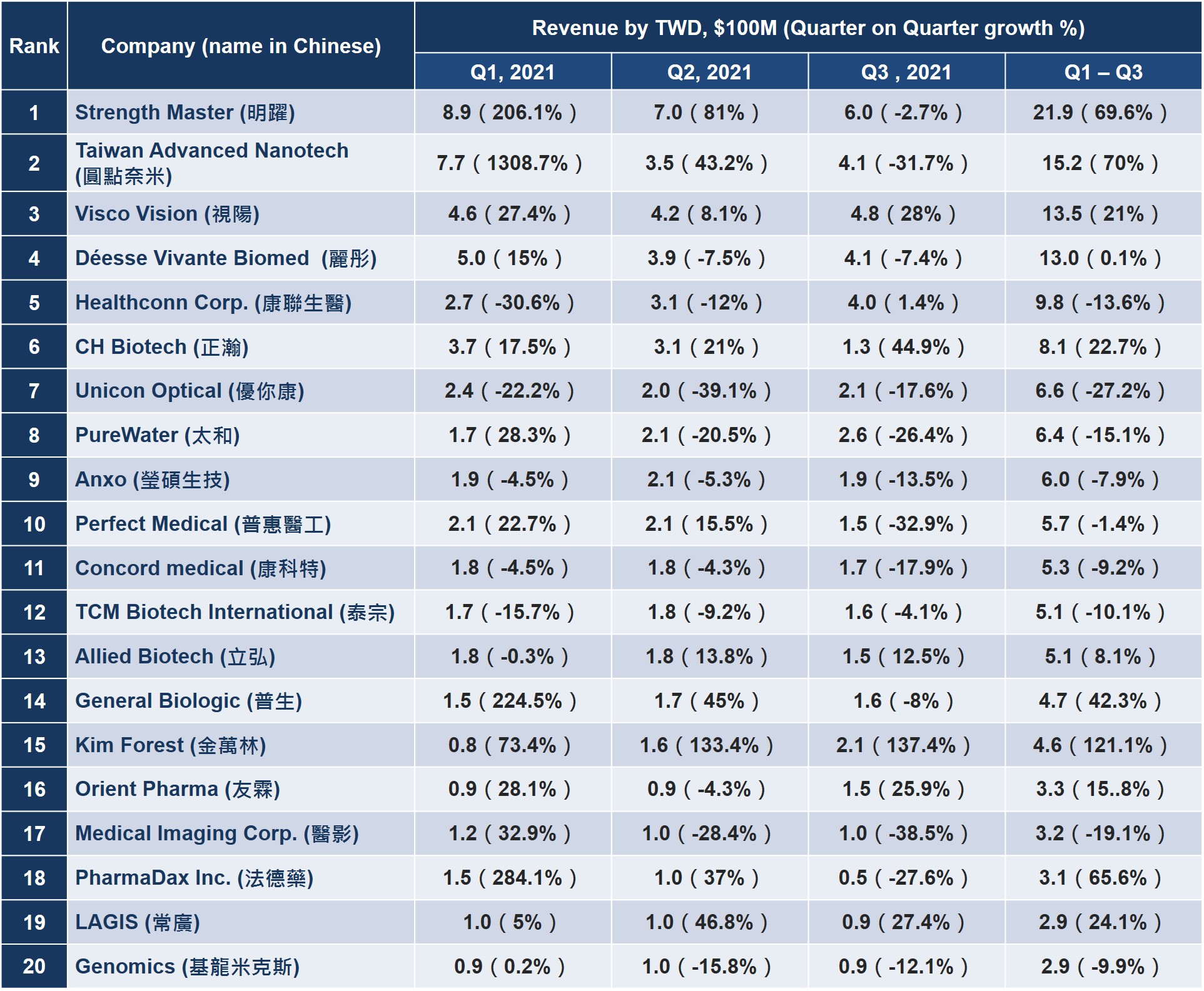

Top 20 by revenue Q1 to Q3, 2021: Emerging stock companies only

- Top 3 by revenue were Strength Master ($2.19bn), Taiwan Advanced Nanotech ($1.52bn) and Visco Vision ($1.35bn).

- Top 3 by growth rate were Kim Forest (121.1%), followed by Taiwan Advanced Nanotech (70%) and Strength Master (69.6%).

Source compiled by IBMI & RBMP.