Copyright©IBMI&RBMP

Over two decades of developing new drugs, that investment has started bearing fruit. This article provides an overview of Taiwan’s new drugs with permits to sell overseas and brief introduction to how these drugs were taken to global markets and indication(s) either in trial or in development.

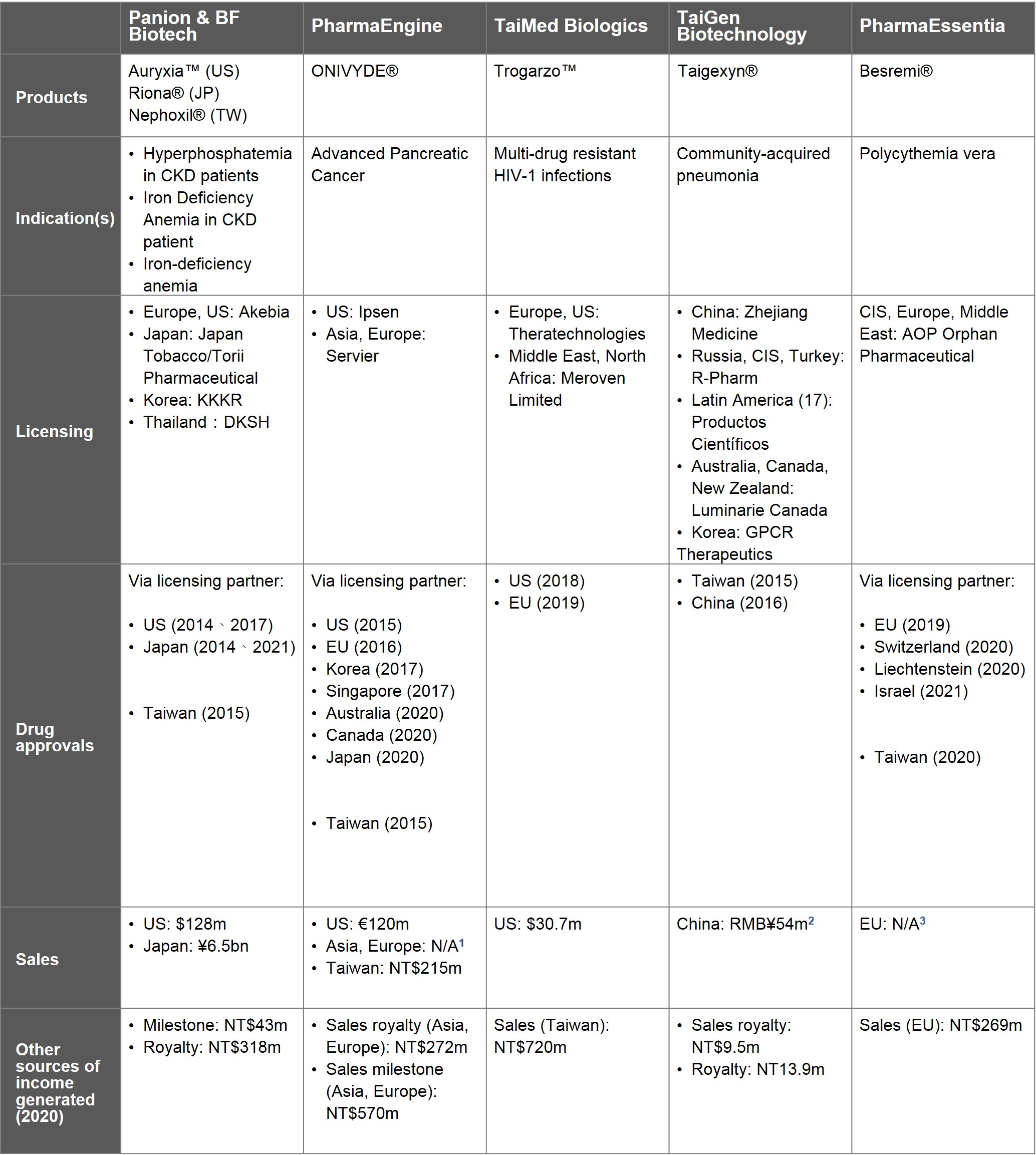

Taiwan has 18 new drugs with R&D accomplished and approvals granted in accordance with the Act for the Development of Biotech and New Pharmaceuticals Industry, 7 of which proceeded with global launch- Nephoxil®, ONIVYDE®, Trogarzo™, Taigexyn®, Besremi®, Megaxia®, and Naldebain®.

The coverage of Taiwan-developed drugs in global markets excluded Megaxia®, a specialty generic drug, and Naldebain®, which was approved in Singapore at the end of 2020.

◾ Development

In 2001, Panion & BF Biotech (PBF) obtained the sole global license from Michigan University for the fundamental technology behind Nephoxil and began new drug development. After completing the multinational, multicenter Phase II clinical trials in the US and Taiwan in 2005, PBF entered a licensing agreement with NASDAQ company Keryx Biopharmaceuticals for collaboration in Europe, the US, and Japan. In 2007, Keryx sublicensed their rights to the Japanese market to Japan Tobacco / Torii Pharmaceutical. In 2014, Keryx and Torii Pharmaceutical obtained drug licenses in the US and Japan, respectively, while PBF obtained its Taiwan drug license in January of 2015 for treatment of hyperphosphatemia in dialysis patients with chronic kidney disease.

◾ Sales

Akebia Therapeutics acquired Keryx in 2018. According to publicly available data from Akebia, Auryxia™ sales reached USD $110 million in 2019 and USD $128 million in 2020. Sales of JT-Torii's Riona® in Japan was JPY ¥6.6 billion in 2019 and JPY ¥6.5 billiojn in 2020. The two major markets- US and Japan combined, hit NTD $5.2 billion in sales. The annual licensing royalty contributed NTD $361 million to PBF's revenue.

◾ Licensing and new indication(s)

In addition to out-licensing in the US and Japan early on, PBF has been developing new markets. PBF and its licensing partner in Korea, KKKR, have the drug under review for approval. In the Chinese market, PBF is partnering with Shandong Weigao through a joint venture to have pushed forward Phase III. In Thailand, PBF licensed DKSH in 2019 for the drug approval and distribution.

Development of new indications is also underway. Keryx was given the greenlight in 2017 following sNDA (supplemental new drug application) for renal iron-deficiency anemia. JT-Torii has also filed sNDA for iron-deficiency anemia while PBF is conducting Phase III pivotal trial for renal iron-deficiency anemia. Moreover, the aforementioned companies are also obtaining patents and planning to conduct extension studies for delaying chronic kidney disease progression and fighting arteriosclerosis.

◾ Development

In 2013, PharmaEngine entered into a licensing agreement with US-based Hermes Biosciences for the development of PEP02 in Europe and Asia. In 2009, Hermes was acquired by Merrimack Pharmaceuticals. PharmaEngine announced Phase II results of PEP02 for pancreatic adenocarcinoma and gastric cancer in the beginning of 2011. Later in May, PharmaEngine licensed Merrimack for development and sales in Europe and Asia. The agreement with Merrimack allowed PharmaEngine to retain the exclusive development and commercialization rights in Taiwan whilst being eligible to receive milestone payments and royalties on sales in Europe and Asia.

Merrimack licensed Baxalta the rights of PEP02 in regions outside the US and Taiwan in 2014, then sold the rights in the US to Ipsen in 2017. Baxalta was acquired by Shire in 2016, which then sold its cancer business unit to Servier in 2018. In the end, Servier owns the rights in all regions, with the exception of the US and Taiwan. As the result of the efforts of the aforementioned companies, ONIVYDE had begun selling since 2015 in more than 40 countries including the US, Taiwan, Europe, Korea, and Japan for the treatment of pancreatic adenocarcinoma patients for whom the first-line gemcitabine treatment has failed.

◾ Sales

In 2019, sales of ONIVYDE in the US by Ipsen generated NTD $4.5 billion and NTD $4 billion in 2020. For the European and Asian markets, despite Servier having no publicly available data, it could be inferred that ONIVYDE was a success as per NTD $272 million royalty and the NTD $570 million milestone payments listed in the financial statements. As for Taiwan, the drug bagged NTD $215 million in 2020. In total, ONIVYDE contributed NTD $1.057 billion in profits to PharmaEngine.

◾ Licensing and new indication(s)

The market is continuing to expand for ONIVYDE. Ipsen has applied for a drug license in China, and review is underway. Meanwhile, ONIVYDE has entered Phase III as a first-line drug for pancreatic adenocarcinoma and as a second-line drug for small cell lung cancer.

◾ Development

After obtaining the sole global license for Ibalizumab (TMB-355) from Genentech in 2007, TaiMed Biologics completed Phase II trials in 2011. The FDA approved the use of TMB-355 as an orphan drug to treat patients with multi-drug resistant HIV-1 in 2014 and designated that of a breakthrough therapy the following year. In 2016, TaiMed Biologics completed the Phase III pivotal trial. In the following two years, TaiMed signed an agreement with a Canadian company- Theratechnologies, for exclusive sales and marketing rights in US, Canada and Europe. TMB-355 was approved in the US and the EU in 2018 and 2019, respectively, for multi-drug resistant HIV-1 infections. TMB-355 has been marketed as Trogarzo™.

◾ Sales

The first year- 2019 in the US made USD $27.7 million, USD $30.7 million (approx. NTD $850 million) in 2020. Sales in the European market did not begin until September of 2020 in Germany. Trogarzo™ altogether contributed NTD $720 million to TaiMed Biologics in 2020.

◾ Licensing and new indication(s)

Outside the US and European markets, where Theratechnologies is responsible for the sales, TaiMed Biologics signed a 10-year contract with Meroven Limited in 2019 for exclusive marketing rights that covered Middle East and North Africa.

To expand its user base, TaiMed Biologics has been conducting clinical studies in the US for TMB-355 in combination with other AIDS medications. In order to increase the convenience of taking medication, TaiMed Biologics has completed clinical trials for administration by IV push. Meanwhile, TaiMed's Canadian partner, Theratechnologies, has begun Phase III trials for intramuscular injection.

◾ Development

TaiGen Biotechnology obtained the rights to develop Taigexyn in 2004 from P&G Pharmaceutical, and took over development after Phase Ia. In 2009, P&G Pharmaceutical was merged into Warner Chilcott and, in 2012, TaiGen obtained the global patent from Warner Chilcott free of charge according to the contract. In December of the same year, the combined Phase III trials in China and Taiwan of the oral dosage form of Taigexyn was completed, with Zhejiang Medicine (ZMC) licensed to proceed with the production and sales of the drug in China. Taigexyn® was approved in Taiwan and China in 2015 and 2016 respectively, for treating community-acquired pneumonia.

◾ Sales

Sales of Taigexyn in China collected approximately CNY ¥54 million in 2020. The product contributed NTD $23.4 million, which included royalties from China and product sales in Taiwan, to TaiGen's revenue in 2020. In 2021, TaiGen transferred its rights in China to ZMC. As part of the agreement, TaiGen will receive payments of USD $10 million upfront and approximately USD $35 ~ $40 million over two years.

◾ Licensing and new indication(s)

To develop new markets, TaiGen licensed Russia-based R-Pharm in 2014 to develop markets in Russia, the Commonwealth of Independent States and Turkey. In 2016, TaiGen licensed Productos Cientificos 17 countries across the Latin America region, where the drug approval is being applied for. In 2020, TaiGen licensed Luminarie Canada to develop the Canadian, Australian, and New Zealand markets; while in Korea, GPCR was contracted. Altogether TaiGen's licensing extends to more than 30 markets.

◾ Development

In 2006, PharmaEssentia began investing in the development of long-acting interferon with its single-site PEGylation technology platform. In 2009, Ropeginterferon alfa-2b (P1101) entered clinical trials. In the meantime, PharmaEssentia contracted AOP Orphan Pharmaceuticals based in Austria for the rights of commercializing P1101 to be used on myeloproliferative neoplasms (MPNs) in Europe, the Commonwealth of Independent States, and Middle East. Subsequently AOP started Phase I/II trials in polycythemia vera (PV) in Europe. In 2019, AOP confirmed the EU’s drug approval, followed by Switzerland’s approval in 2020 and Israel’s in 2021. Back in Taiwan, PharmaEssentia received the drug approval in 2020.

◾ Sales

AOP did not disclose the total values of Besremi®. According to an annual report released by PharmaEssentia, the exports generated NTD $293 million and NTD $269 million for 2019 and 2020, respectively.

◾ Licensing and new indication(s)

While in other markets, the approval of Besremi® are making progress. In US it is taking a few more final steps to complete site inspection and drug approval process; Korea- site inspection accomplished and application for drug approval submitted; Japan- bridging trials being conducted; China- a phase II single-arm bridging trial green-lighted.

New indications in development include chronic hepatitis C (CHC) genotype 2, essential thrombocythemia (ET), and chronic hepatits B. The former two have entered Phase III trials and recruitment for the trial in CHC genotype 2 had been closed in Taiwan, Korea, and China. The global multinational, multicenter Phase III trial for ET has been recruiting since 2020 from the US, Taiwan, Japan, Korea, China, Singapore, and Eastern European Countries.

This article outlines Taiwan’s strength in developing new drugs that have commercial values. The pharmaceutical sector, over 20 years of development, has been full-fledged and sophisticated with R&D, patents and licensing, regulatory affairs, product rollouts and even negotiations. Most recently a couple of deals led by Taiwan-based drugmakers suggests a rather proactive approach being taken when engaging with counterparts. Last year Oneness Biotech entered a license agreement with LEO Pharma in Europe which hit a record milestone payment up to USD $530 million, which topped the amount of its kind compared to all other licensing for drugs in phase I trials. Foresee Pharmaceuticals's new prostate cancer drug pushed forward a license agreement with Intas Pharmaceuticals in the US and GeneScience Pharmaceuticals in China with royalty of USD $331 million.

More new drugs from Taiwan with licensing and earning potentials are thus anticipated to get into the right hands and right markets.

Taiwan-developed drugs in global markets

Source: Data released by respective companies, compiled by IBMI&RBMP

Note 1: Servier did not disclose sales of ONIVYDE

Note 2: An estimate based on the 2020 annual report of Zhejiang Medicine

Note 3: No publicly available data of Besremi sales by AOP