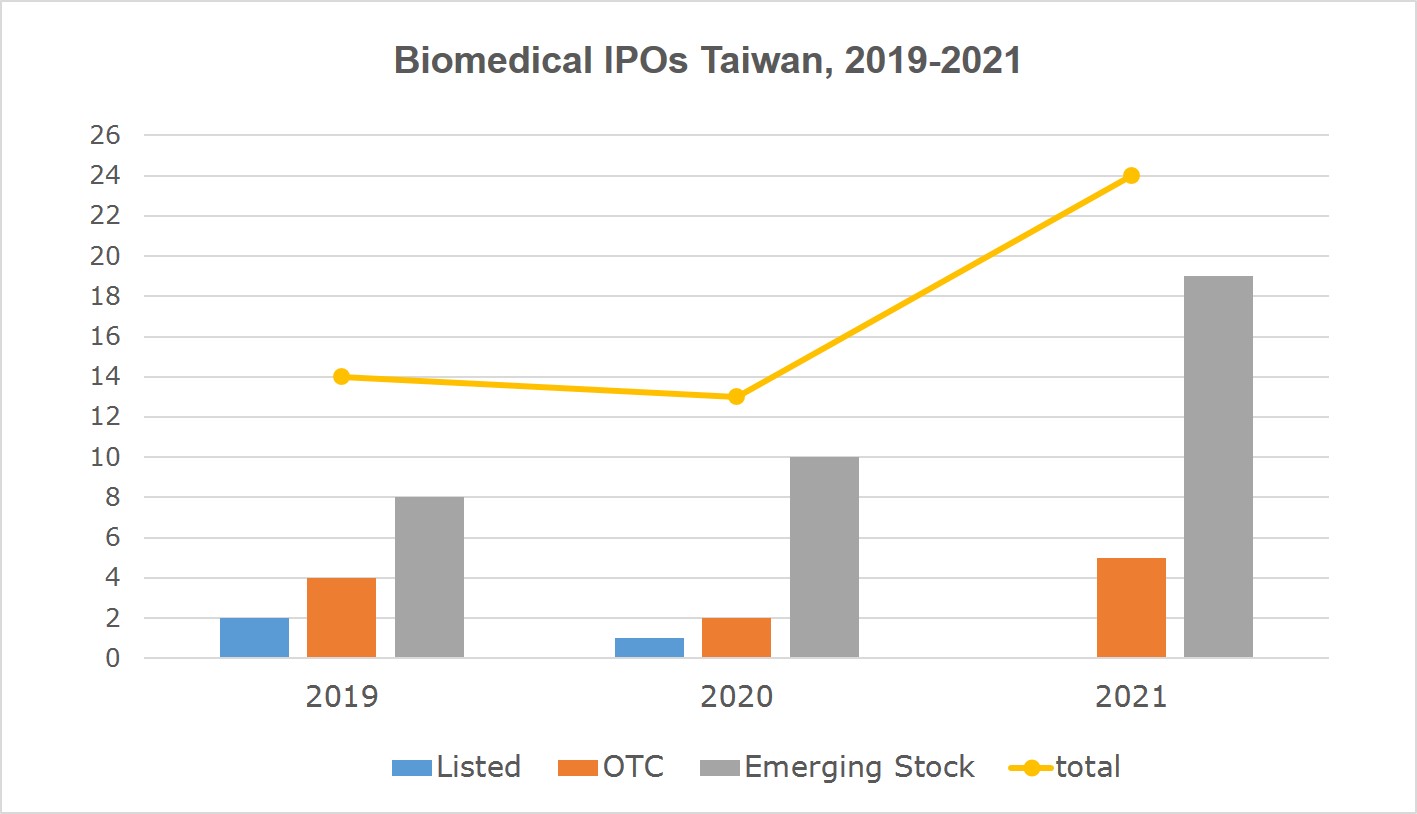

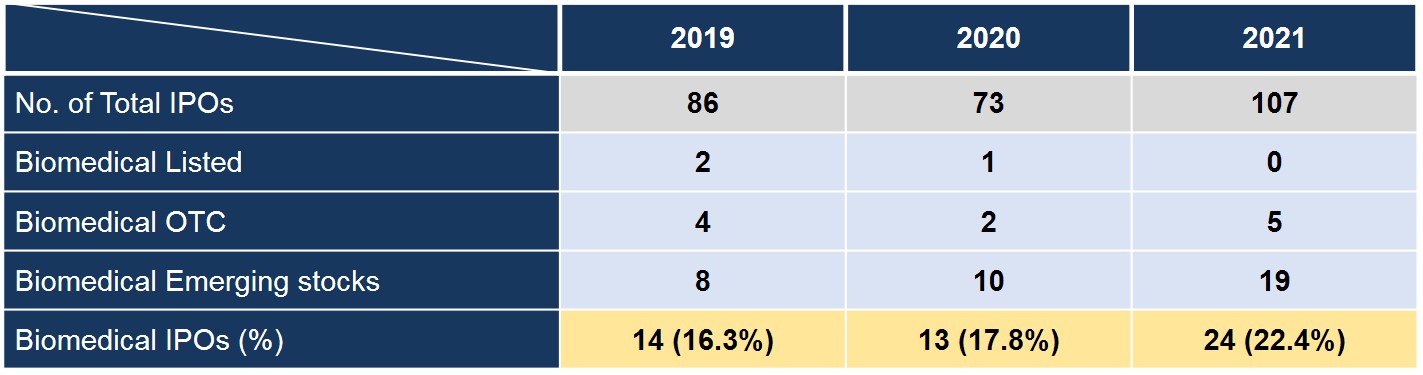

The year of 2021 ended with spikes of IPOs from the technology and healthcare sectors, which suggested a similar trend to continue on into 2022. Back in Taiwan, nearly a quarter of companies that went public last year were bio-and-medical relevant ones. This article shows new IPOs, their market values and popular targets.

One out of four IPOs contributed by the biomedical sector

Companies in 2021 with stocks publicly traded climbed to 107- a paramount number in three years past- of nearly a quarter (24) from the biomedical sector. That cohort of 24 consisted of 5 OTCs and 19 emerging stocks as per the Taipei Exchange, posting a notable growth in 2021 compared to merely 13 in 2020.

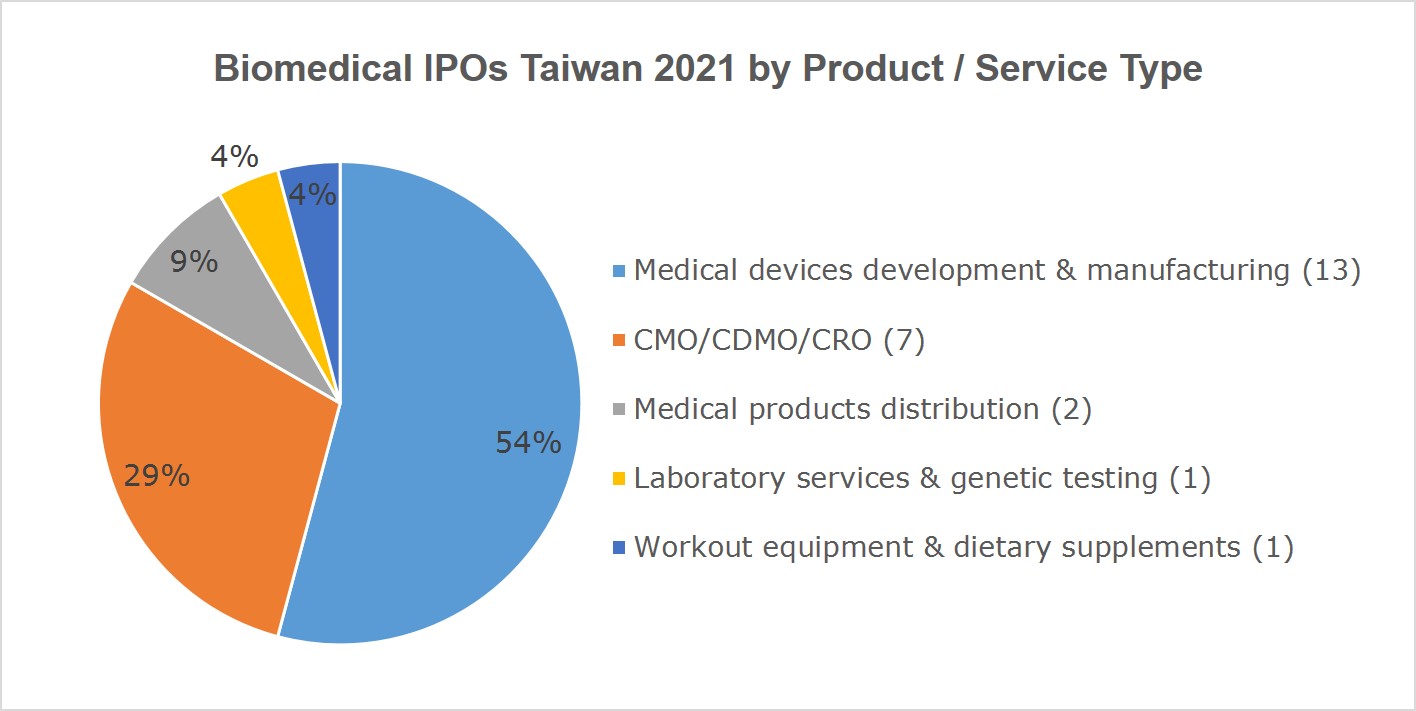

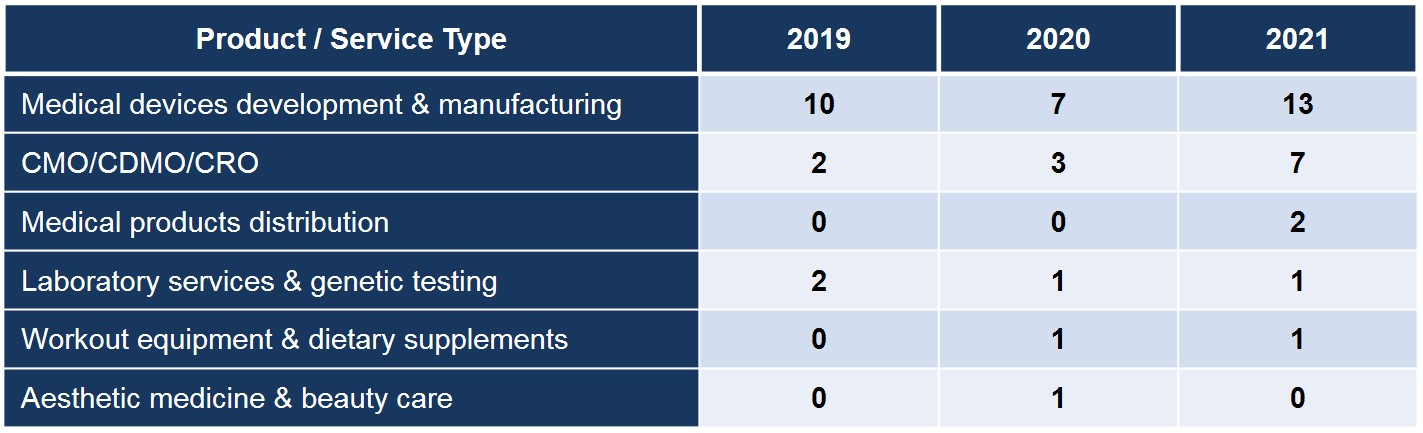

Digital health, diagnostics and pharmaceuticals dominate the IPO chart

Breaking down by product/service types as shown below, companies offering “medical devices development & manufacturing” went from 6 in 2020 to the hike of 13 in 2021, followed by seven in “CMO/CDMO/CRO” and two in “medical products distribution” businesses. “Laboratory services & genetic testing” and “Workout equipment & dietary supplements” occupied a place each in terms of IPOs.

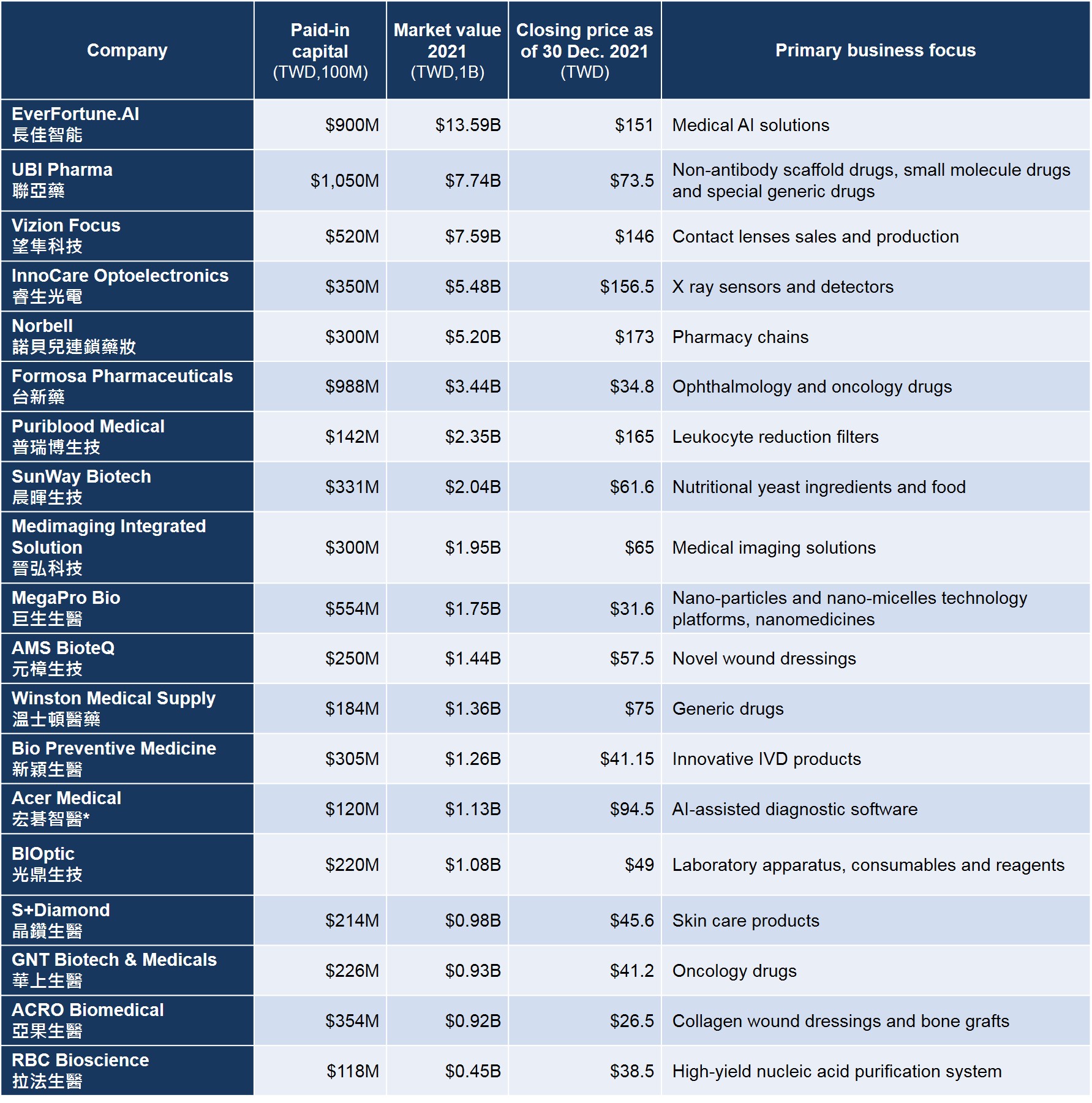

Looking further into companies whose businesses are “medical devices development & manufacturing”, four associated with digital health, including EverFortune.AI (長佳智能) and Acer Medical (宏碁智醫) with provision of AI-assisted diagnostic tools, and Medimaging Integrated Solution (晉弘科技) and InnoCare Optoelectronics (睿生光電) specialising in medical imaging systems. Three IPOs relevant to diagnostics were completed by BIOptic (光鼎生技), RBC Bioscience (拉法生醫) and Bio Preventive Medicine (新穎生醫). There were five drugmakers who also took a slide of the pie: UBI Pharma (聯亞藥), Formosa Pharmaceuticals (台新藥), MegaPro Bio (巨生生醫), AMS BioteQ (元樟生技) and GNTbm (華上生醫).

New IPOs by number: 2019-2021

New IPOs by market value

New IPOs 2021 were valued at a total of TWD$85.28bn (an average of $3.55bn). Ever Supreme Biotechnology (長聖生技) and EverFortune.AI (長佳智能) valued over $10bn whilst Brighten Optix’s value (亨泰光學) jumped by 116.5%.

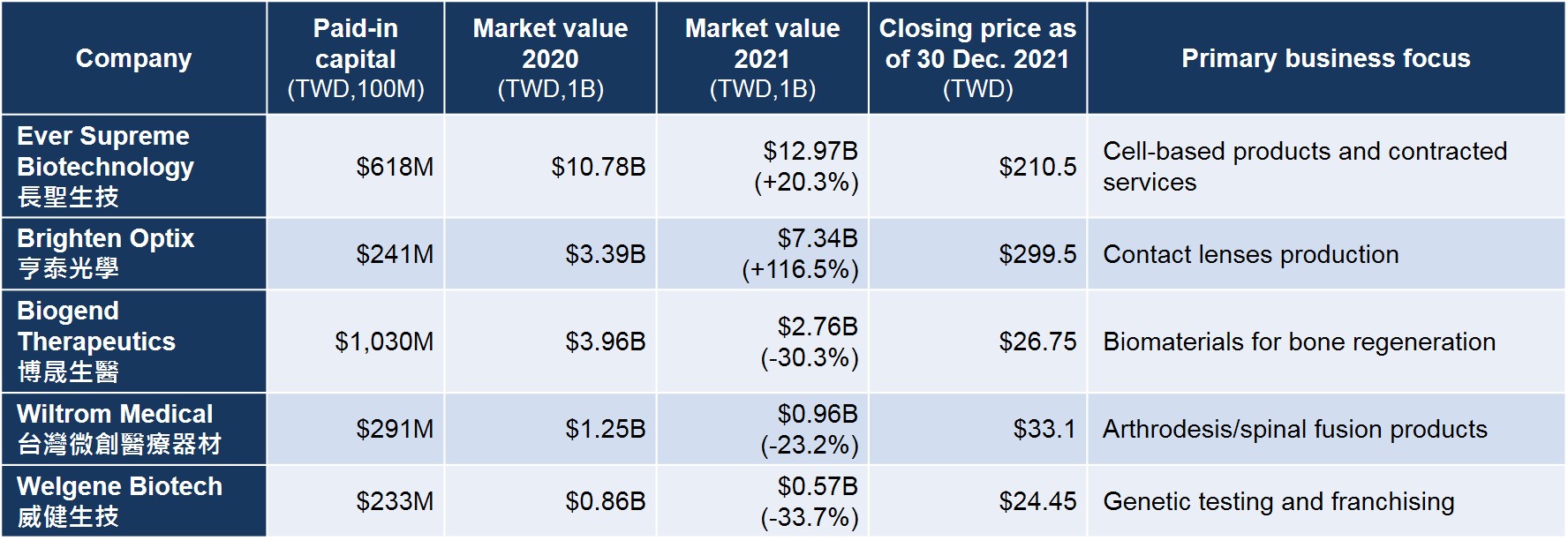

New IPOs by market value: OTC companies

New IPOs by values: companies on emerging stock market (Taipei Exchange)

*Acer Medical, a subsidiary of Acer, listed on Taipei Exchange’s Emerging Stock Board under the healthcare category.

Source: MOPS, yahoo finance; compiled by IBMI&RBMP